At last Monday’s Committee of the Whole Council meeting, the audited financial statements for 2020 were presented. The audit was clean – KPMG signed off saying that the statements were truthful (that’s really what an audit does – looks for untruths or errors). Jennifer Heslinga, from the Town’s Finance Department made a long presentation and apart from a few interesting items, it was all about esoteric accounting details with an emphasis on what the pandemic did to the numbers and how the reserves work. Frankly, I did not understand the details on reserves so I’ll just report the interesting items. For example, where did the money come from and where did it go. Big picture? Cobourg gets only 47% of its income from the tax levy and the Police are the biggest expense.

Overview

Compared to budget, $11.9M went into reserves in 2020 compared to a budget of $2.2M. That’s because although some revenues like user fees went down, grants and other revenues went up. Plus expenses went down due to hiring freezes and reducing services. Northam Park remains profitable and provided a $2M contribution. The CCC is of interest to many; it has a remaining debt of $2.81M which matures in 2033.

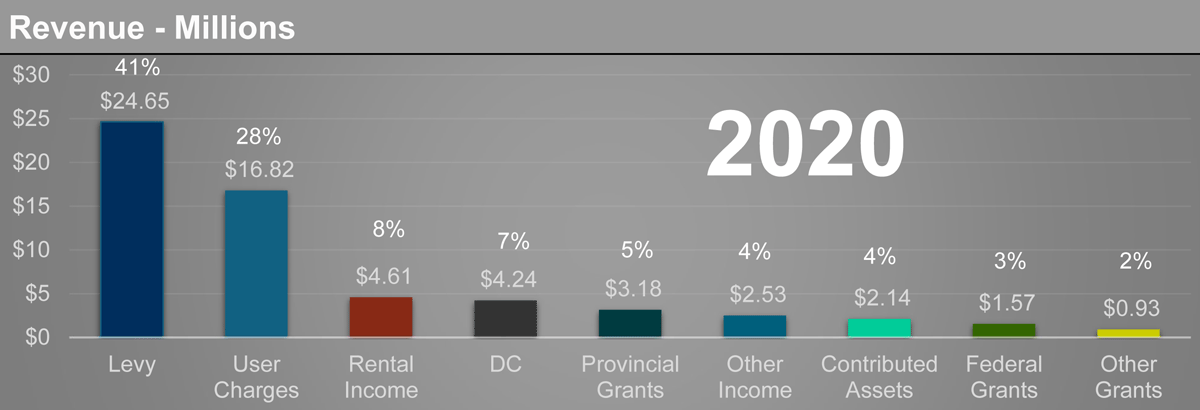

Revenue

Actual revenue for 2020 was $60.7M and 41% of this came from the tax levy – see all sources in graphic below.

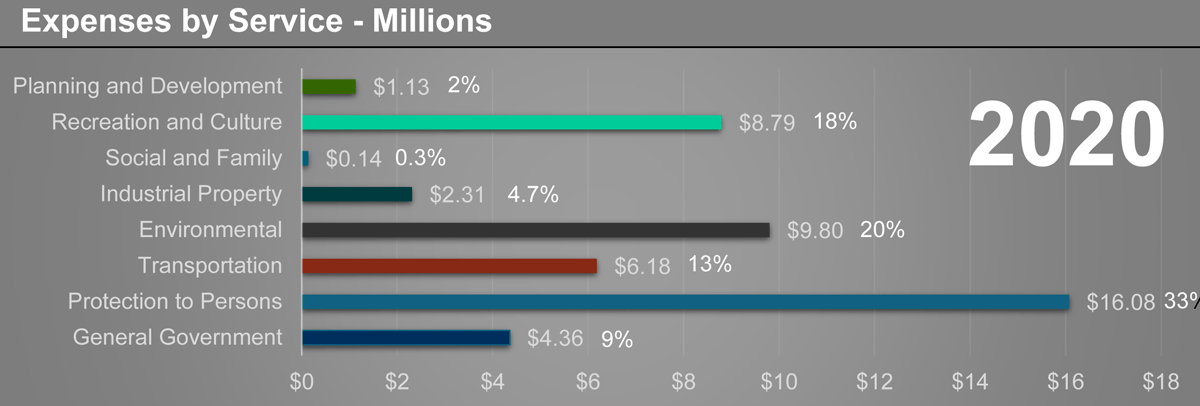

Expenses

So where does the money go? Here is a graphic showing expenses by Service.

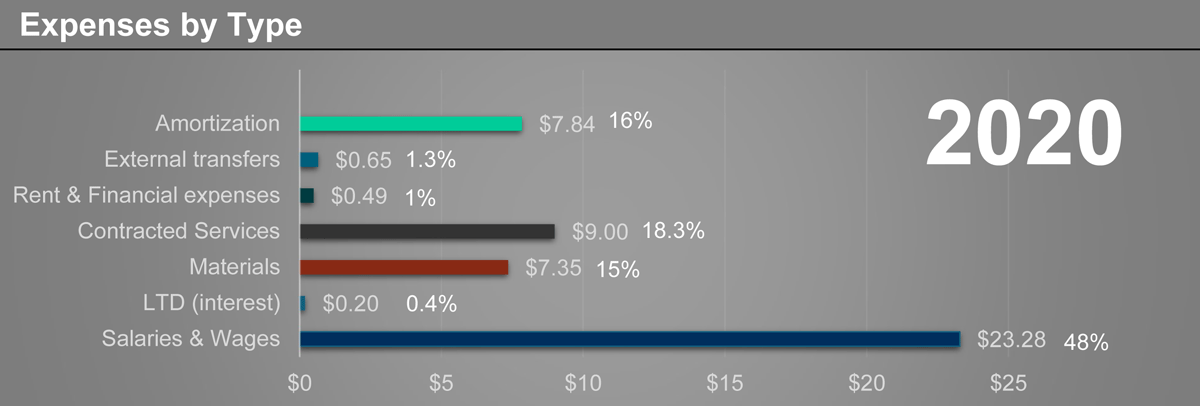

And how much went on Salaries and Interest etc.?

In terms of performance, Cobourg did well in 2020 – the reserves had a substantial increase and will help cover pandemic problems in 2021. We learned some interesting things about the budget – I don’t recall this level of detail in previous reports by the Town although the County has provided this kind of breakdown.

I note that interest payments are low – that’s good. Jennifer said that the interest rate for long term debt is 2.49% to 3.47% and the interest paid in 2020 was $171K.

But the budget increase number that was agreed by Council on Monday was a levy target of 3.1% increase. It was not explained why a good 2020 still means a high increase in 2022. Do we need the extra $9.6M in reserves that we were not expecting? I guess you need to be an accountant to follow the reasoning. To be fair, Jennifer’s presentation came AFTER Council agreed to the target for the levy increase.

Links

Print Article:

The 2020 Town of Cobourg Audited Financial Statements are now available to view on the Municipal website.

The consolidated financial statements reflect the assets, liabilities, revenues, and expenses of the operating and capital budgets. Detailed note disclosures also reflect additional information such as accounting policies, reserve fund balances, long term debt schedules, and tangible capital asset schedules of the reporting entity.

Visit http://www.cobourg.ca/finance to learn more.

Thanks for this posting John. Do you know when the Town is going to post the complete KPMG 2020 consolidated audited financial statements on their website? The last posting is for 2019.

https://www.cobourg.ca/en/town-hall/Financial-Statements.aspx#

I don’t know their schedule – meanwhile most of that info is in the presentation available to download above. You can also get additional explanations by watching the video,.

Old Sailor:

The Town’s Audited FS 2019 were not available until October 2020. Hopefully the 2020 FS will be released earlier than October this year.

You may find the Town’s Financial Information Report (FIR) interesting. This report provides the same info as the audited FS but in much more detail, as well as a lot of stats and metrics.

The FIRs are available for many years and for each municipality in Ontario including the counties and regions. Cobourg typically does not file its FIR until Oct/Nov, Many municipalities file late (after June), but some, including some in Northumberland file closer to the due date.

https://efis.fma.csc.gov.on.ca/fir/index.php/year-municipality/year-2019/

Bryan

I get a lot of information out of the notes to the financial statements. It is too bad that municipalities do not have to publicly file their audited statements in a reasonable length of time. TSX public companies generally have 90 days to file their year end audits.

Old Sailor:

I agree. There is a great deal of information in the FS notes. For me, the notes are a very important source of information.

The Municipal Act requires that the Town’s FS be published 60 days after receipt from the auditor. The catch is there is no control over when the auditor releases the FS.

The Town is incorporated under the provisions of the Business Corporations Act of Ontario. The act provides that the corporation’s financial statements must be provided to the shareholders (usually at an annual general meeting) within 6 months of year end. This requirement is largely ignored in favour of the more lenient provisions of the Municipal Act. An unfortunate jurisdictional overlap

I believe a big chunk will be many of the positions they froze hiring on and now must fill and hopefully they reconsider bringing lifeguards back in 2022. Hopeful with a change in parking fees for non-residents and other user fee changes will help offset. I’m sure there were many other things that were pushed back that will now have to be paid for in 2022…fire truck to name one I can’t remember when that was being put off to.